Is MEV a good investment opportunity? - by Zixi Zhu

MEV originally refers to the Miners Extractable Value, applied under POW, is to measure the profit that miners can obtain by arbitrarily adding, excluding or reordering transactions in the blocks they produce. MEV is not limited to miners in proof-of-work (PoW) based blockchains, but also applies to validators in proof-of-stake (PoS) networks. The Maximum Extractable Value refers to the maximum value that can be extracted by the verifier in the block production exceeding the standard block reward and gas fee by adding, deleting and changing the order of transactions in the block under POS. Now MEV generally refers to the Maximum Extractable Value.

After Ethereum has transitioned to POS, any user who pledges 32ETH can become a validator. In each block generation duration, a validator will be randomly selected as the block proposer to package and execute the transaction into a new state, and then the proposer will package the block to other validators for verification. From the above description, it seems that the validator should find a way to arrange the transaction order of the block in order to be profitable. But in fact, most MEVs are arranged by Searcher. This is because Searcher needs to have specialized algorithm technology to perform search calculation and sorting. Searcher submits it to the proposer through its algorithm in Mempool/private domain channel, and the proposer will then package it into the blockchain. One of the examples of MEV is the sandwich attack.

MEV has pros and cons. The advantage is that it can improve the efficiency of DeFi, and rely on Searcher to quickly equalize the price difference. The disadvantage is that some MEVs greatly affect the user experience. For example, the attacked users will face higher slippage and extremely poor user experience, and due to the existence of gas priority fee, Searcher will sometimes greatly increase gas fees, resulting in network congestion and very poor user experience.

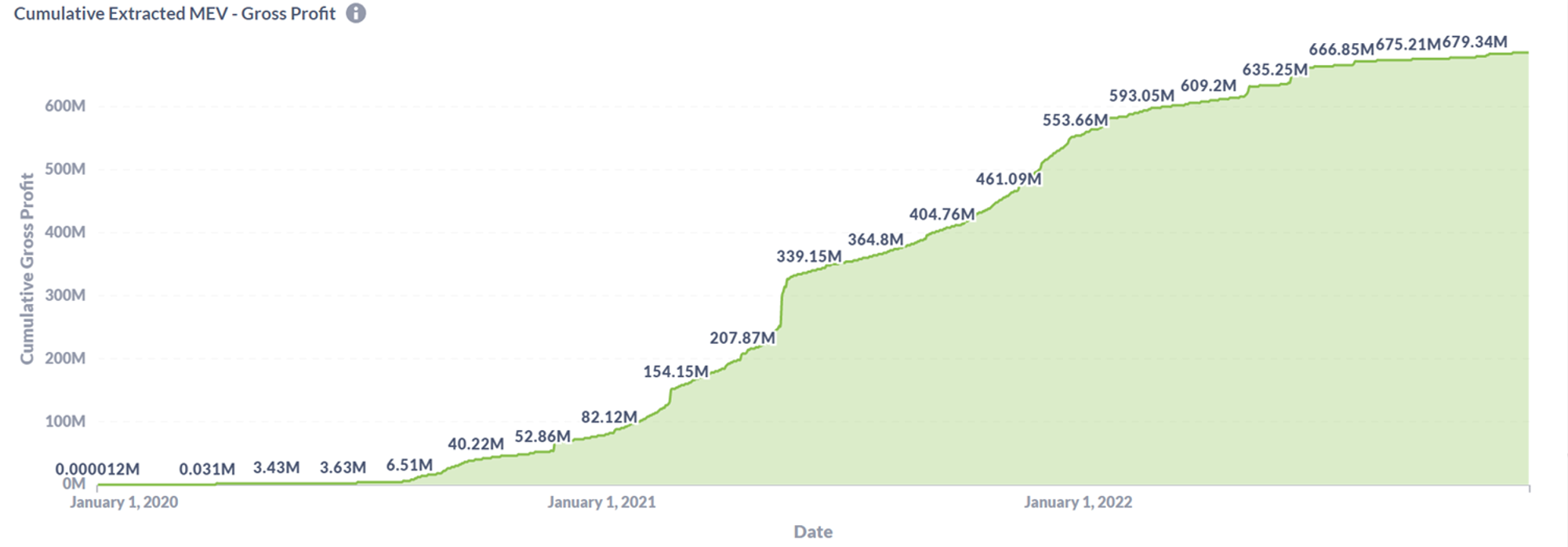

Figure 1: The MEV situation of the top 10 DeFi in Ethereum over the years

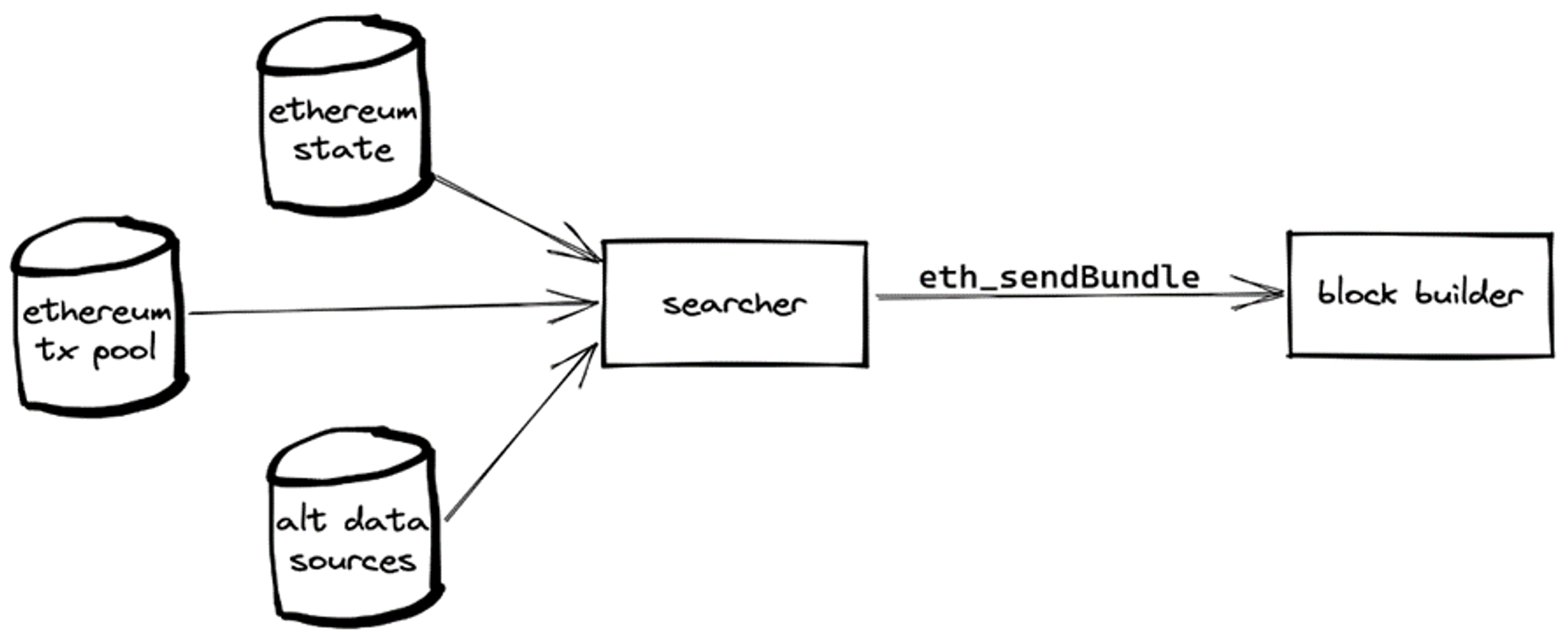

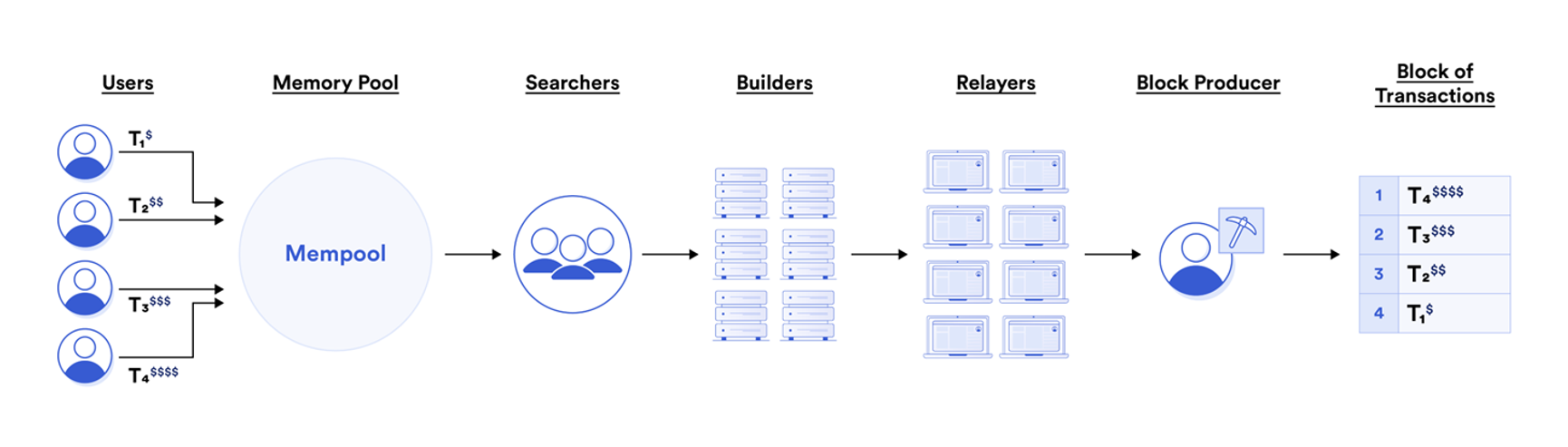

The following briefly describes the responsibility of each role in MEV on Ethereum.

Searcher is responsible for monitoring the public transaction pool and Flashbots private transaction pool, and then uses the algorithm to calculate the most profitable transaction sequence in the block, and then packages and sends it to Builder. At this time, Searcher will give a bid, expressing the maximum cost that it is willing to pay. This cost is only visible to the Builder, not to everyone through the P2P network, thereby reducing the pressure on the chain.

Figure 2: Searcher listens to public trading pools and private trading pools to use algorithms to quote

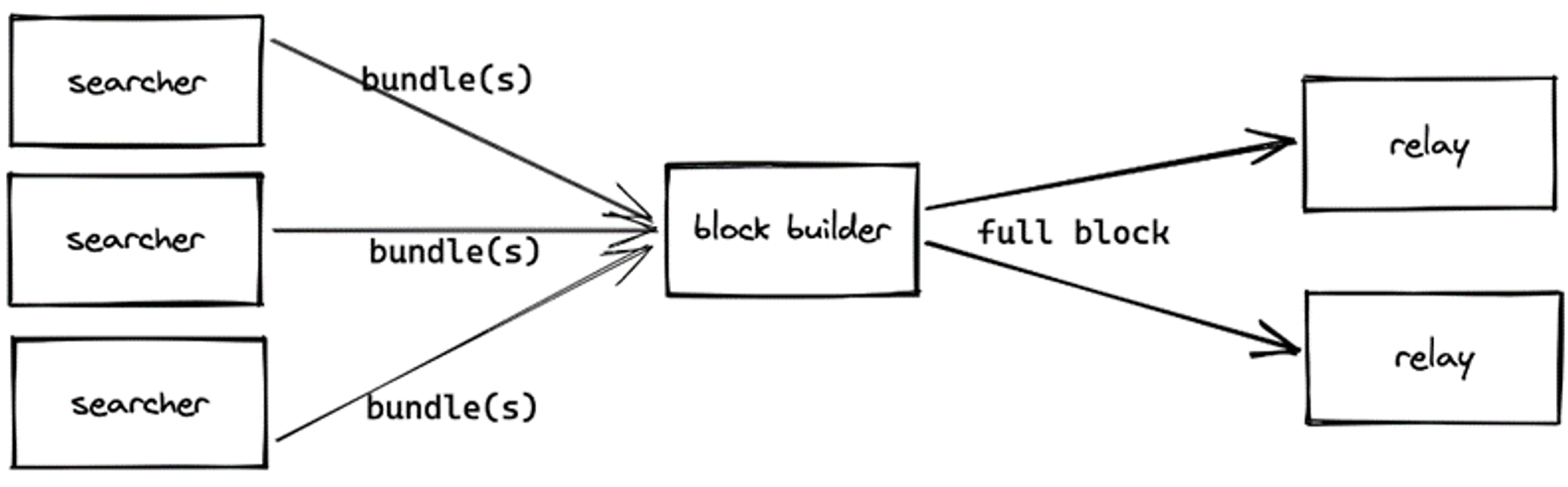

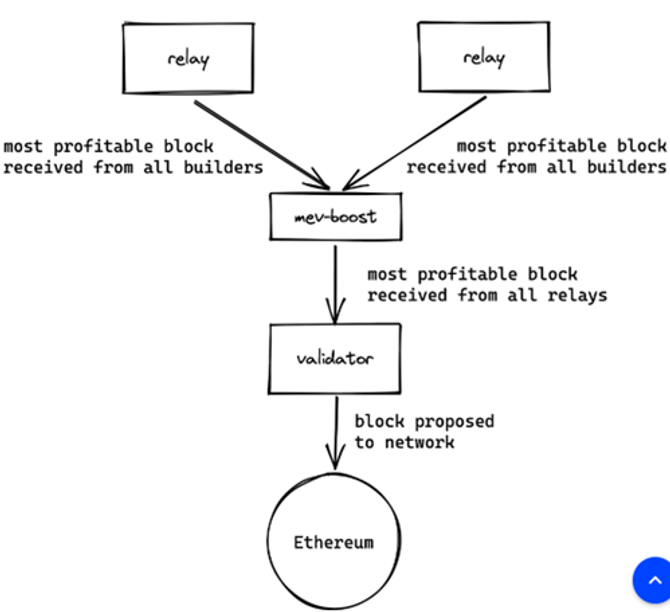

Any user who downloads MEV-Boost can become a Block Builder. The Builder accepts the transaction from the Searcher, and further selects a profitable block, and then sends the block to the relay through MEV-Boost.

Figure 3: The Builder collects quotes from different Searchers

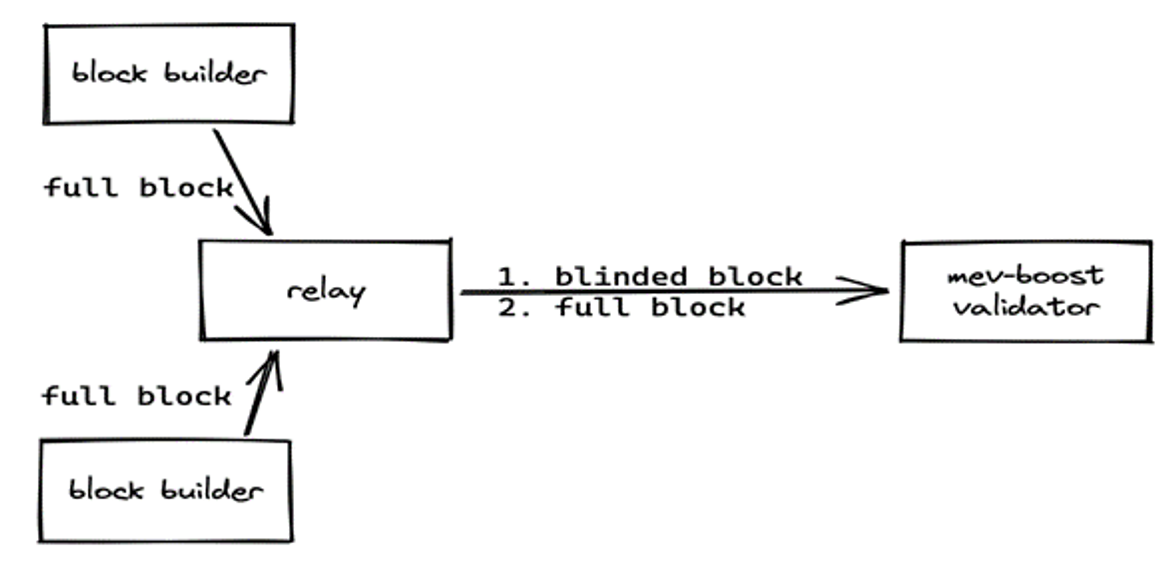

The Relayer is an integral part of realizing the separation of PBS, hosting the blocks from the Builder for the Proposer. The Relayer accepts the blocks transmitted by the Builder and passes the most profitable block headers to the Validator. After the Validator has verified the block header, the Relayer sends the entire block to the Validator to speed up the Validator's work efficiency.

Figure 4: The Relayer collects blocks from different Builders

Any user under POS can pledge 32ETH to become a Validator. Currently Lido is the largest Validator. As long as the Validator uses MEV-Boost, it can select the most profitable block from the proposals of multiple Relayers, and charge a priority fee, and then select a Proposer among the many Validators to produce a block.

Figure 5: Proposer (Validator) finally selects the most profitable block for construction

Figure 6: The entire MEV industry chain

Most MEVs include several forms:

- DEX risk-free arbitrage. Searcher uses on-chain data for analysis, and uses price difference + flashloan in DEX for risk-free arbitrage.

- Liquidation in lending. The Searcher queries the data on the chain at the fastest speed to determine which borrowers can be liquidated, and then submits the liquidation transaction first and charges the liquidation fee.

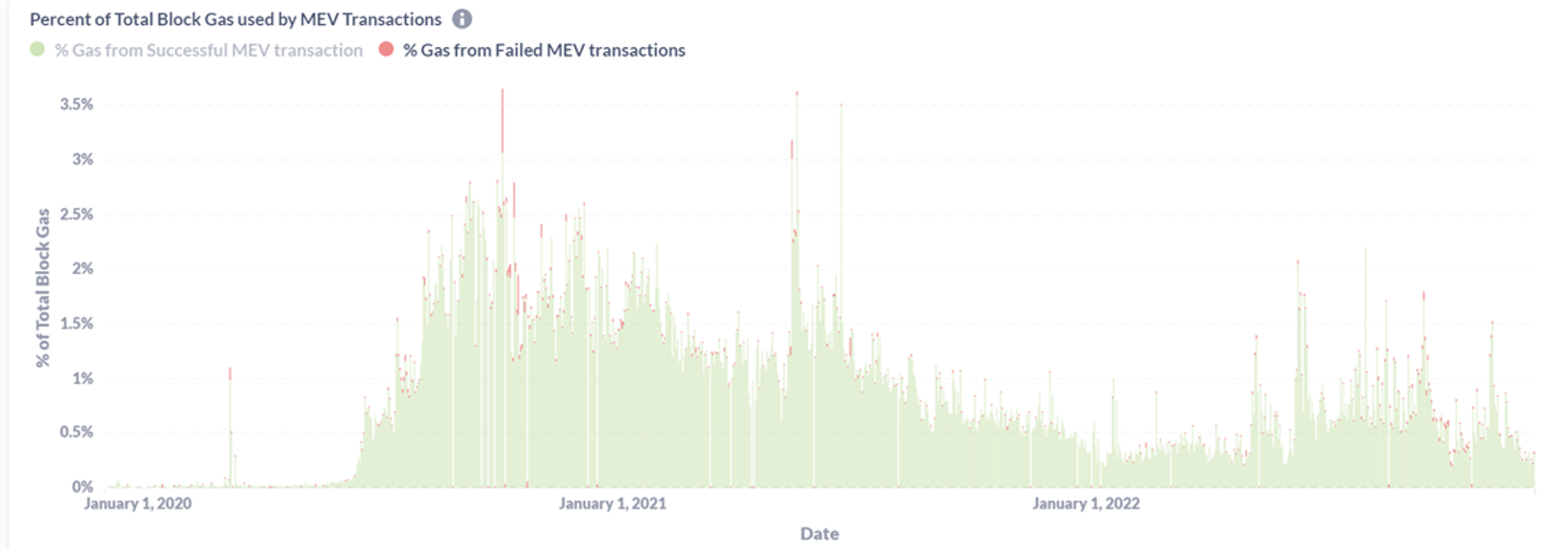

- Sandwich attack. For example, I want to spend 1 million US dollars to buy ETH on UniSwap, which will lead to a large demand increase of ETH in UniSwap. To complete the sandwich attack, on the premise that Searcher pays the highest gas priority, Searcher only needs to monitor the transaction pool, advance his order of buying ETH prior to myself, and then sells it immediately after I buy it. Although MEV may fail, that is, the gas priority fee is not high enough, but it can be seen from the figure that the cost of failure is negligible in the total cost (failure cost + success cost).

Figure 7: Among MEVs, the cost of failed MEVs is small

Flashbots is a R&D company that aims to mitigate negative externalities (such as on-chain congestion) caused by MEV. Flashbots has launched several products, such as Flashbots Auction (with the Flashbots Relay), the Flashbots Protect RPC, MEV-Inspect, MEV-Explore and MEV-Boost, etc. Here we will focus on two products, Auction (MEV-GETH) and MEV-Boost.

Before Flashbots Auction, such as in the DeFi Summer from 2020 - early 2021, the surge in the usage of Ethereum brought a lot of negative externalities, such as high gas and Ethereum congestion. This is due to the fact that in the past with regular transaction pools, users broadcast gas bid fees P2P to all nodes, and then miners (now validators) calculate the most profitable blocks. This open bidding method will lead to high gas, and all ordinary retail investors will also have to bear high gas, resulting in poor user experience. In addition, transactions due to auction failure (due less gas payment) will also be restored on the chain, occupying a certain block space, which will eventually lead to waste of block space and reduced revenue for miners (validators), a lose-lose situation. So Flashbots created Auction to alleviate the above problems. Auction provides a private transaction pool + private bidding block auction mechanism, allowing validators to outsource the most profitable block construction work without trust. In this private transaction pool, searchers can communicate privately and do not need to pay for failure.

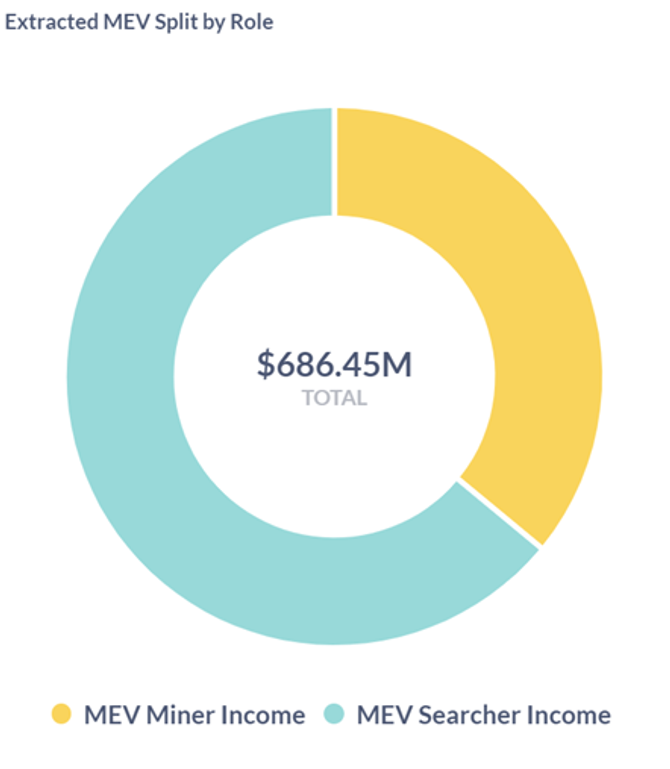

MEV-Boost is developed by Flashbots and relies on an open-source middleware run by Validator on the chain to complete the Block building business, thereby realizing the separation of Proposer and Builder under POS. At present, PBS has not been implemented, so it will lead to scale effect and centralization, that is, the larger the mining farm, the more capable it is to develop algorithms to improve its Search ability; but at present, PBS has been written into the development history of Ethereum. MEV-Boost selects the most profitable block to the Validator by linking multiple relays. MEV-Boost also currently has an adoption rate of over 90%. However, as more and more users participate in MEV, the competition for MEV becomes fierce. Seacher's profit began to be reduced, and Producer's profit began to increase. Judging from the current cumulative data, 64% of MEV’s total profits are still occupied by algorithm-led Searchers. In addition, MEV also exists on other chains, such as BSC, Avalanche, etc. The competition of other chains is not fierce, but the ceiling is relatively low.

Figure 8: Searcher's revenue gross profit is around 64%

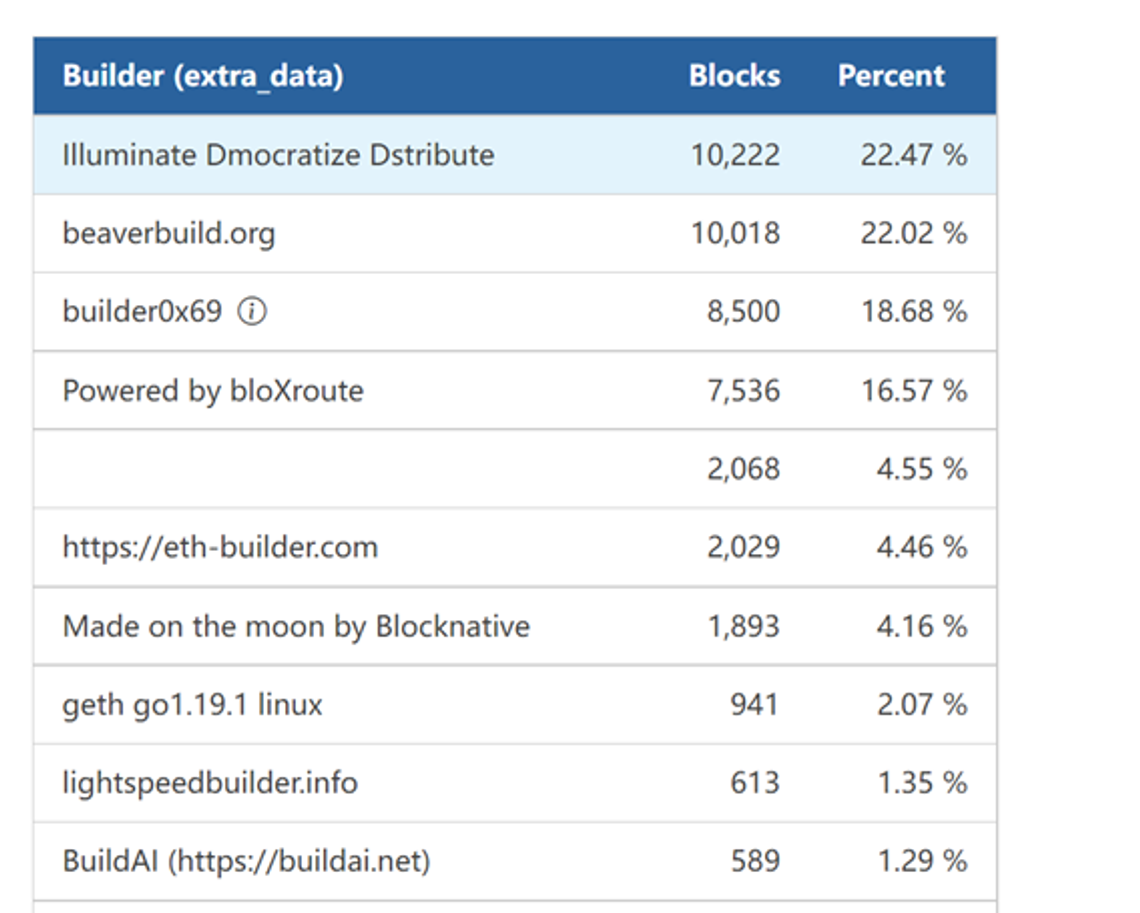

A current trend is builder centralization - CR5 has reached 84.29%. The Builder will have an exclusive order flow (because the Builder has a preset privacy function or it is easier for the builder to choose the transaction sent by the user) and can be cross-chain (the user can not only send me the Ethereum transaction, but also send me transactions on other chains to let me pack), so the builder is gradually centralized. The centralization of Builder will lead to the invalidation of Ethereum POS decentralization. Therefore, in order to solve the above problems, Flashbots developed SUAVE (the Single Unified Auction for Value Expression).

Figure 9: Builder is becoming more and more centralized

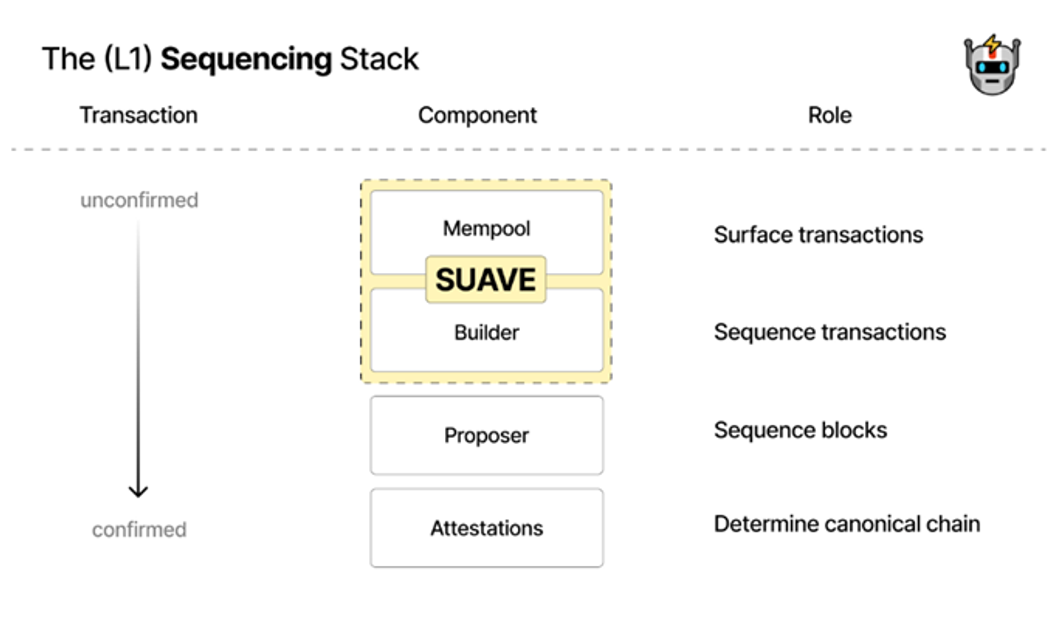

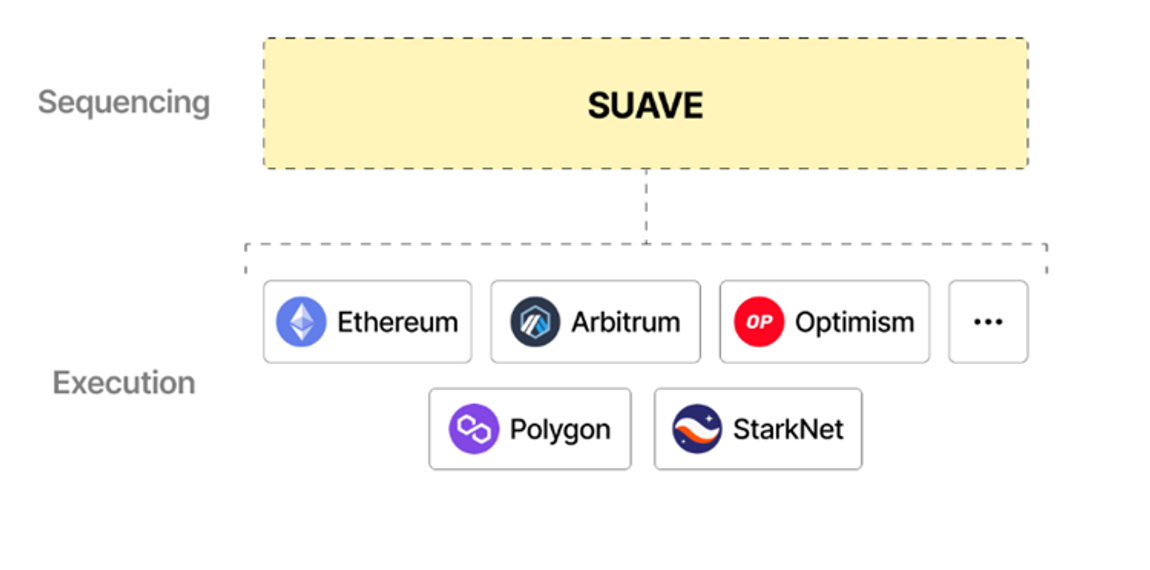

SUAVE is an independent blockchain, but it can be understood as a plug-in that can be inserted into any chain, acting as the Mempool and Builder of other chains. SUAVE separates the Mempool and Builder of all chains from other roles to achieve professional management, so as to improve the efficiency of the whole chain (if multi-chain is not set, then the builder in a single chain will be phased out). SUAVE achieves a win-win situation, that is, the blockchain itself is more decentralized, the validator's income is maximized, the searcher/builder can set preferences and the potential income increases, and users can also conduct private transactions at the cheapest price.

Figure 10: SUAVE architecture

Figure 11: SUAVE can realize cross-chain MEV

According to the statistics of Flashbots, MEV will earn 70K ETH in 2022 from the top 10 DeFi projects on Ethereum, or 133 million US dollars in revenue. Compared with the cumulative income of 188K ETH in the bull market of 2021, the revenue of 475 million US dollars has dropped sharply. The reasons are as follows: on-chain transactions have turned bearish (full-chain DEX transaction volume has dropped from $1.575T in 2021 to $1.255T in 2022), and the leverage ratio has decreased (on-chain liquidation is also one of the profit sources for MEV, but due to excessive declines, the leverage ratio has been reduced), etc. But the overall gross profit margin has increased, from 61% in 2021 to 65% in 2022, because the promotion of Flashbots has increased the gross profit margin of searchers. MEV is highly dependent on the on-chain activity/transaction volume, and the activity/transaction volume is greatly affected by the market. For example, in the bull market of 2021, the overall revenue ceiling was 476 million US dollars.

However, according to recent research, as more and more novice searchers enter the MEV track, the gross profit margin of Searchers has declined severely. The novice searcher directly raised the miner's fee to 99%, leaving only 1% of the profit to the peers, which may lead to another extreme situation. That is, no matter how advanced your algorithm is, once it is copied by peers (after all, this thing is operated transparently on the chain), peers without a tacit understanding will minimize everyone’s excess returns for their own profits. So in the end, no matter how you sort, you have to pay more than 99% of the gas fee, and there is no net profit, so the searcher's sorting motivation will be greatly reduced.

Figure 12: The bull market is full of opportunities and the MEV market is large, but the gas cost is high and the profit margin is low; The bear market has Low trading volume and the MEV market is small, but no more expensive gas war, leading to high profit margin

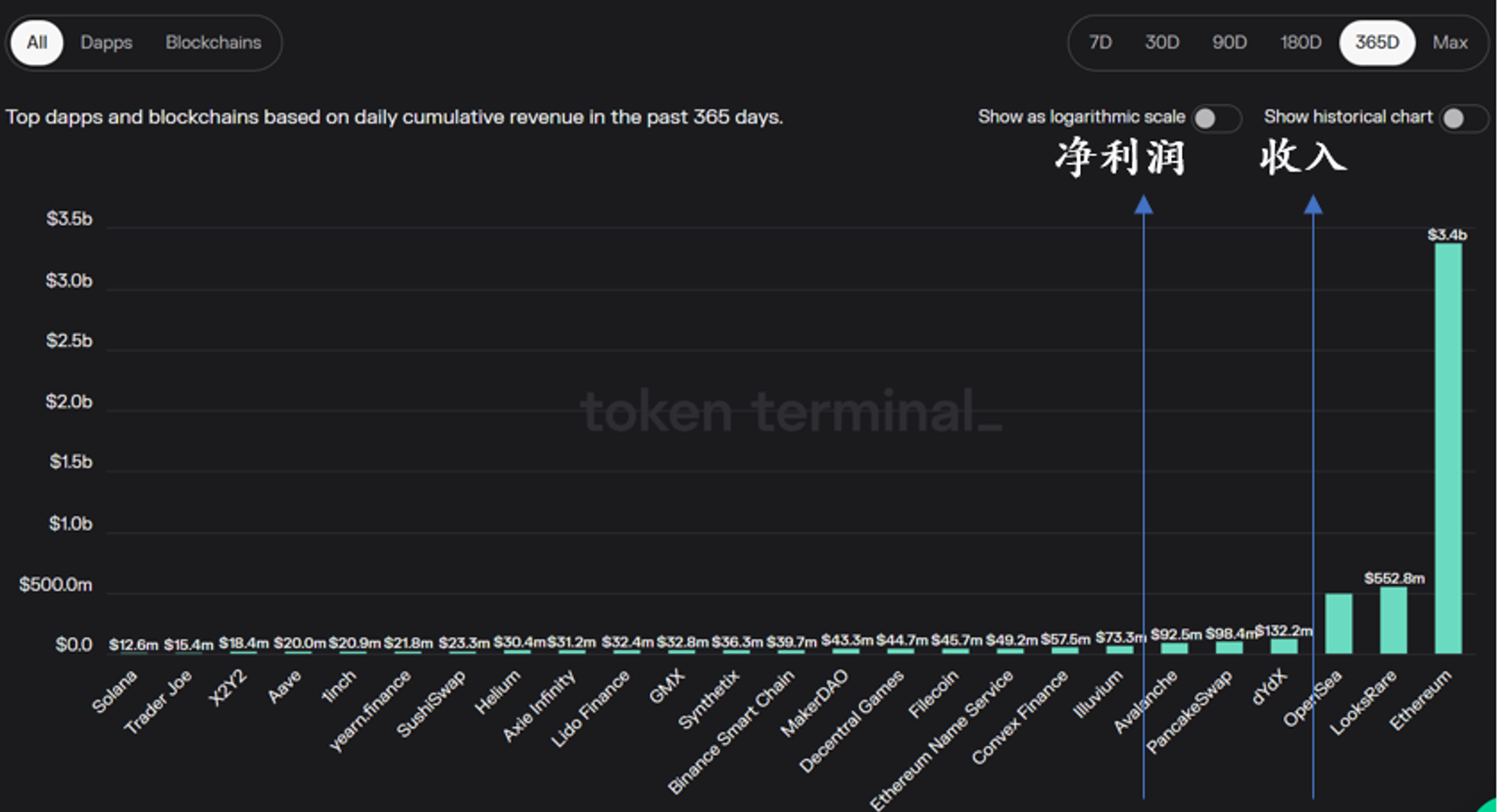

MEV is a track with strong cash flow, and is highly positively correlated with the cycle (on-chain transaction volume, etc.). We select the data of the bear market in 2022, and DeFi, which is also a strong cash flow business, for comparison. Without deducting the cost paid to the miners, we get that in 2022 all Searchers earned $133.7M in the top 10 DeFi projects on Ethereum. This amount is considered a large income in the entire blockchain industry. Although it is not as good as OpenSea and other leading projects, it has much higher income than dYdX, PancakeSwap, Convex, Maker, Synthetix and other projects. In addition, the $134 million only includes the top 10 DeFi projects on Ethereum, and does not include other DeFi, Layer2 and other POS Layer1 revenues on Ethereum. Compared with other selected competitors, the weighted P/S is calculated as 12.43, and finally the weighted P/S is used to calculate the reasonable valuation corresponding to MEV Searcher. This part of the valuation is about $1.662 billion. Therefore, considering the full chain of Ethereum + Layer 2 + other POS Layer 1, the ceiling will be much larger than $1.6 billion.

Figure 13: In 2022, MEV Searcher's revenue is second to Opensea, better than dYdX, and ranks high among all blockchain projects

In summary, MEV is a rare infrastructure track with strong cash flow, high transaction correlation, high income but relatively low risk. MEV will be similar to quant and market makers in some strategies, but because it does not bear any counterparty risk, MEV is more stable than quant and market makers (at least it will not be liquidated as some market makers when the market is volatile). MEV's strategy is more rigid, but the risk is also lower. The most typical example is to make arbitrage in DEX. Judging from the performance of Searcher in 2022, the MEV income brought by the top 10 top DApps on Ethereum was 133.7 million US dollars, minus about 1/3 of the miner’s gas fee, and the final income was about $87 million. Plus other Layer1 and Layer2, the overall MEV income of the blockchain is quite high. However, according to the recent feedback from some searchers on Ethereum, more and more newcomers have begun to enter the MEV track as searchers, which has led to the searchers that were originally oligopolistically competitive gradually turning into perfect competition, and the excess returns were greatly reduced. The income originally belonged to the Searcher was finally attributed to the Validator, which also explains the reason for the increase in Lido's income in the past year and a half. In addition, for other L1s represented by BSC, although the overall scale of BSC's MEV will be smaller than Ethereum's MEV, but due to the lack of a unified bidding system and less intense competition, the overall net profit rate of Searcher will be high. In addition, we have seen MEV projects similar to Flashbots that want to dominate the market on Cosmos.

From the perspective of investors, MEV (Searhcer) is a typical equity structure project, which is as a whole similar to the investment of market makers, while with no counterparty risk, so the overall risk is smaller. Since such companies are less likely to issue coins, the exit path may only be mergers and acquisitions, dividends, etc. The core of judging the MEV (Searhcer) project is still 1. Whether the search algorithm is reliable 2. Whether it can quote to the node immediately 3. Control the cost of gas 4. Expand other chains, etc. Therefore, the overall technical requirements for the team are relatively high, typically not BD-oriented industries, which means it may be suitable for Chinese teams. Therefore, when investing in companies similar to MEV (Searhcer), if the valuation in the first and second rounds is low and the team’s skill is advanced, you can consider to invest. If you consider a MEV bidding system company, if the chain is dynamic enough and there is no unified bidding system, then you may be able to produce products like Flashbots, which may be suitable for Western teams to build infra and then do BD.

Disclaimer: If you are a retail investor who wants to engage in MEV but do not know anything of the technical terms, it is better to buy Lido for staking. Finally you will find out that you are still working for the validators of Lido. It's not investment advice, don't scold me if you get scammed.

85 comments

ud2h0q

6×62no

khemhb

fwnddhtywvopzokxqrxvuevgtjnjtk

sdmkxrizrhiwqjgmxhxjggymxijtov